Face Recognition AI for Financial Sector - Internal Control

ALCHERA

April 14, 2023

April 14, 2023

Table of Contents

Face recognition AI, a trend among biometric technologies

FIDO-based simple authentication: ownership-based+biometric authentication (face analysis)

Install Base Easy authentication: biometric authentication (face analysis)

Why Recognition? Why ALCHERA?

• Low capacity and high efficiency

• Fast recognition speed

• Easy integration and cost savings

New Finance That Alchera Will Change

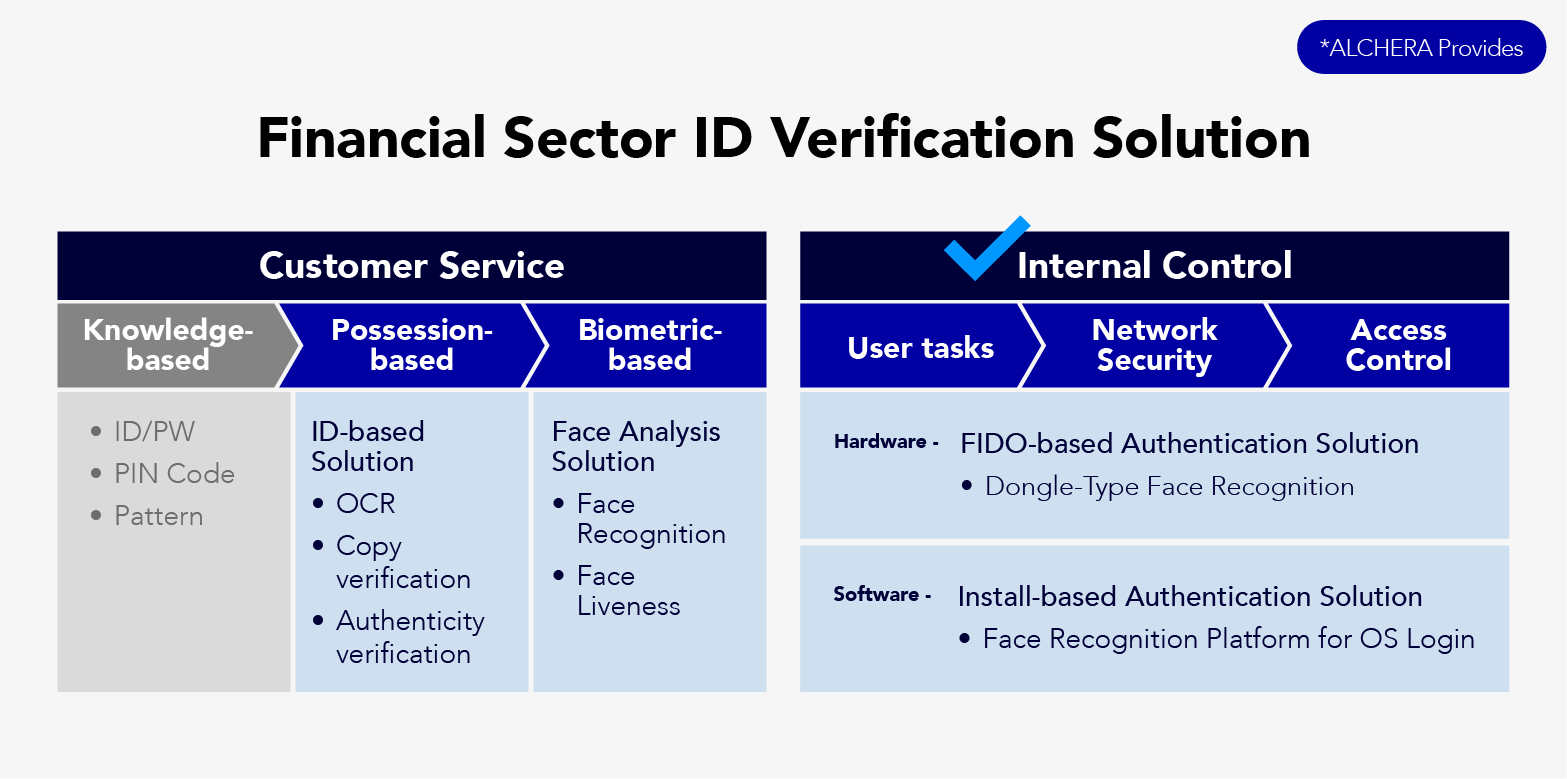

There has been a recent financial system change in Korea. The Korean Financial Supervisory Service announced “a new internal control system for the domestic banks” to address the "insufficient internal control system" issue, which is one of the causes of financial accidents in the banking sector. The plan focuses on “infrastructure innovation, performance, and constant internal control,” with the introduction of biometric technology being a practical alternative to the existing business process. Following the previous episode, we will explore how face analysis can be utilized in the internal control space, following the successful adoption of face recognition AI-based non-face-to-face identification solutions in the financial sector.

Face recognition AI, a trend among biometric technologies

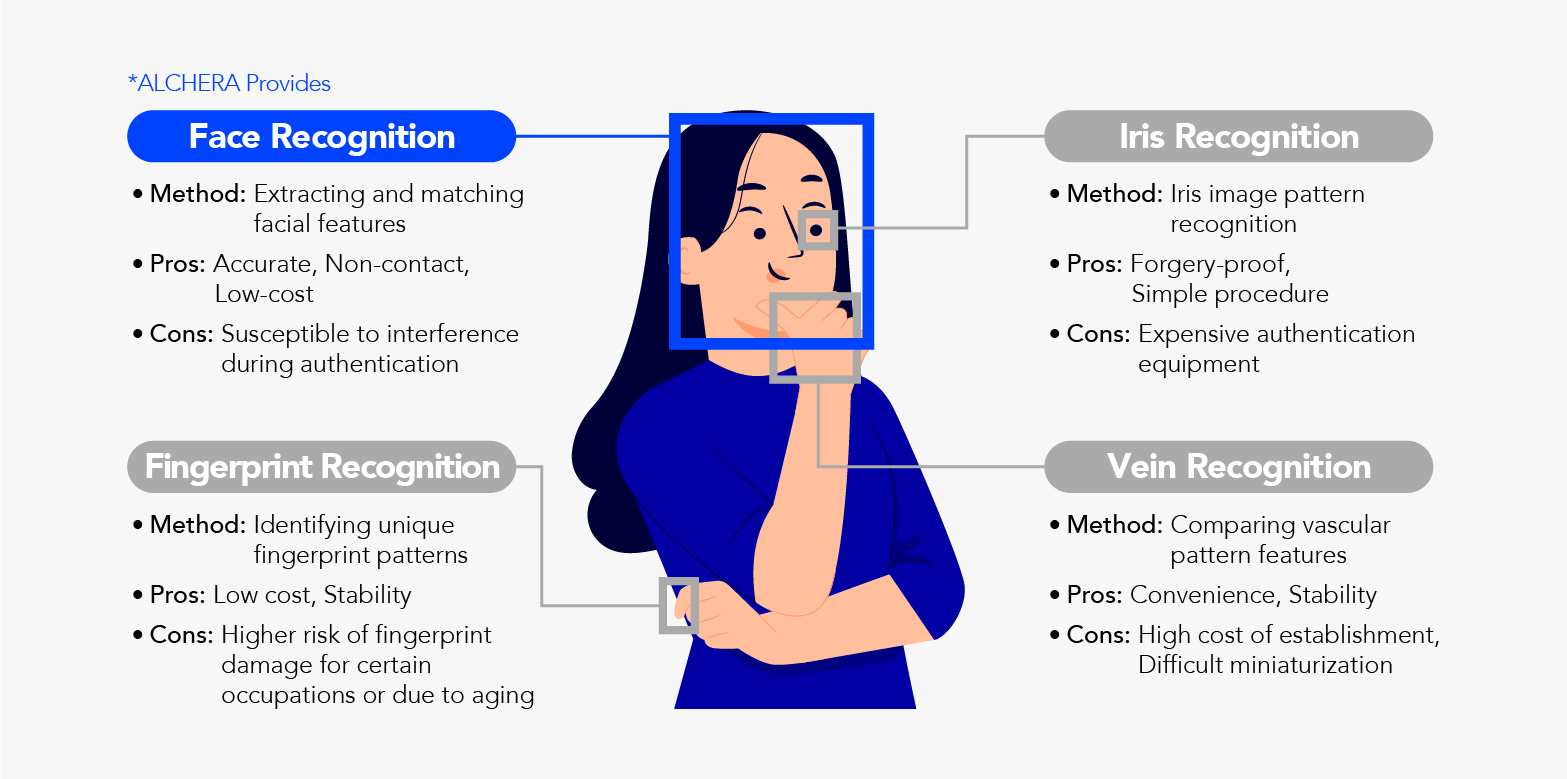

Biometric recognition uses unique biological characteristics such as fingerprints, iris, veins, and face to verify identity. It is more secure than traditional authentication methods, but its adoption in the financial sector has been limited due to varying costs and vulnerabilities.

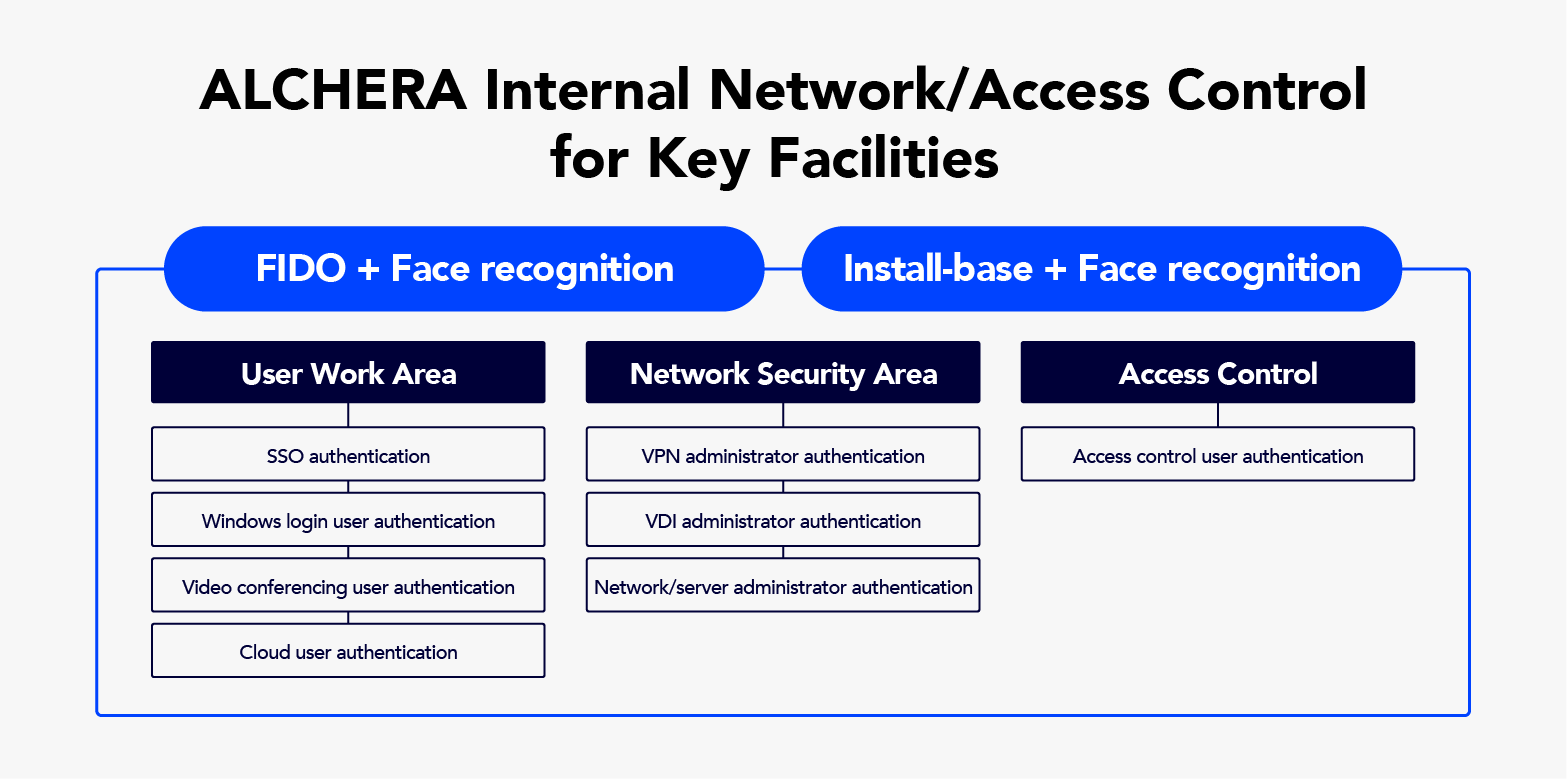

Face analysis is a popular biometric method due to its stability, convenience, and low installation cost. Advances in deep learning have addressed existing shortcomings like makeup, glasses, and masks. Alchera offers a secure internal network/major facility access management solution with face recognition AI technology.

FIDO-based simple authentication: ownership-based+biometric authentication (face analysis)

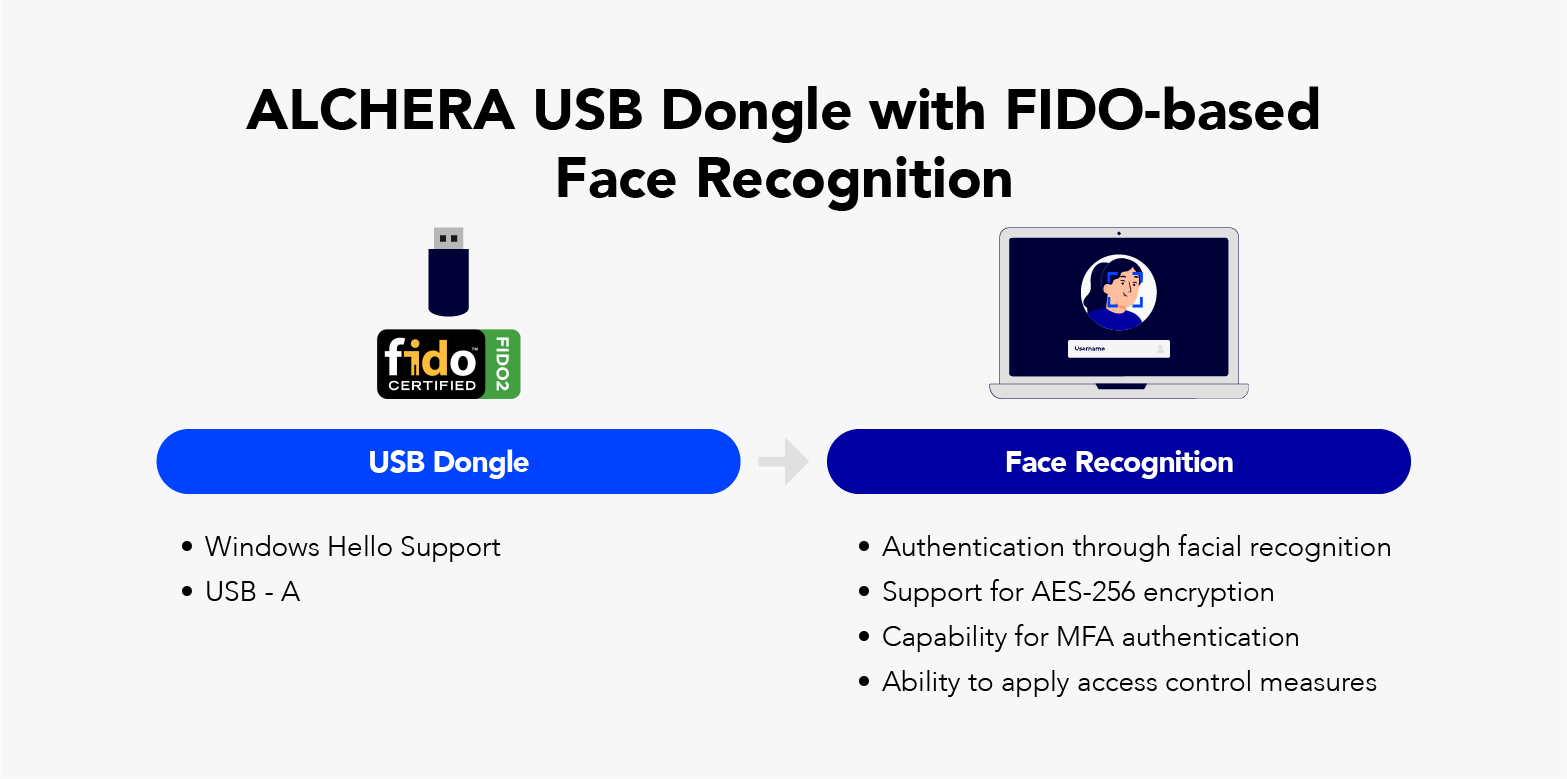

** FIDO (Fast IDentity Online): A technology that uses biometric authentication for rapid online authentication.

** FIDO (Fast IDentity Online): A technology that uses biometric authentication for rapid online authentication.

** AES-256: A symmetric key password storage technology established by the National Institute of Standards and Technology (NIST), using 256-bit AES encryption, which allows all input methods available on the PC to be used as passwords.

** MFA(Multi-Factor Authentication): A method of authentication that uses at least two unique authentication elements to verify identity.

Alchera is the first company in Korea to offer a solution that combines ownership-based face analysis with a FIDO USB dongle. This portable USB enables face analysis even on PCs without built-in face recognition technology. The solution meets the standards of the FIDO Alliance and provides simple and accurate work access authentication, even when working remotely.

** FIDO Alliance: A consortium of companies that aims to establish secure and efficient online authentication and verification standards through the use of biometric technology and other related authentication methods.

- Provides secure access management with USB Dongle ownership-based face analysis solution.

- Supports OAuth 2.0 3-legged authentication and FIDO for user authentication. FIDO client and server are used in conjunction with OAuth authentication.

The ID/PW method has high leakage risks, especially with security vulnerabilities that make it difficult to authenticate an actual employee.

Install Base Easy authentication: biometric authentication (face analysis)

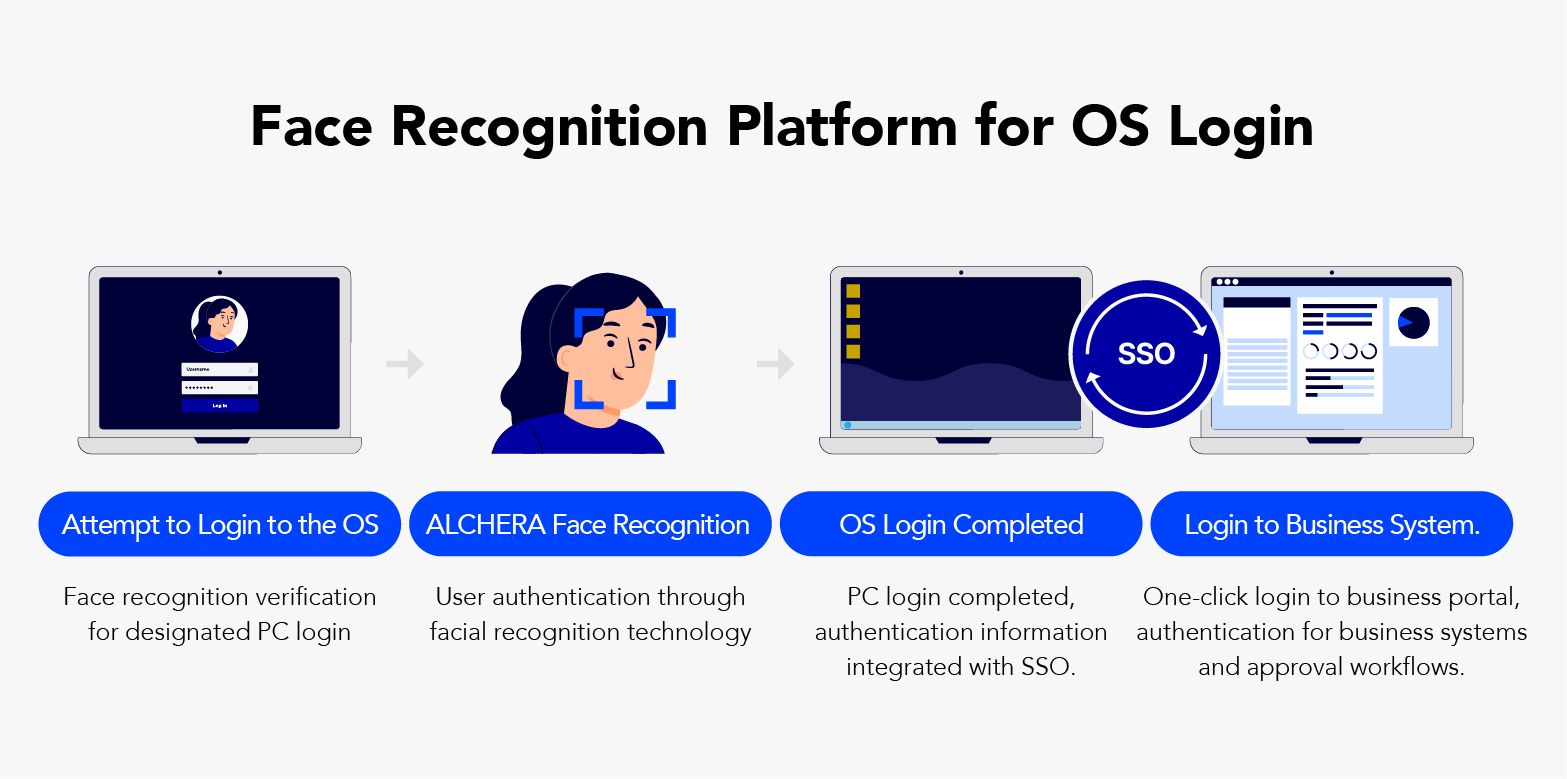

The bio-based authentication platform for the OS login environment enables easy face recognition for user authentication. It's a versatile solution for various business systems, ensuring the accurate identification of all individuals, not just users.

- Supports face analysis for business system login

- Provides facial authentication for user terminals (Agent required)

- Offers mobile-based facial authentication

- Supports MFA certification system

It also provides protection against abnormal authentication by identifying duplicate logins, multiple logins, and unauthorized logins, and notifying registered and unregistered users to quickly respond to hacking or intentional access.

Why Recognition? Why ALCHERA?

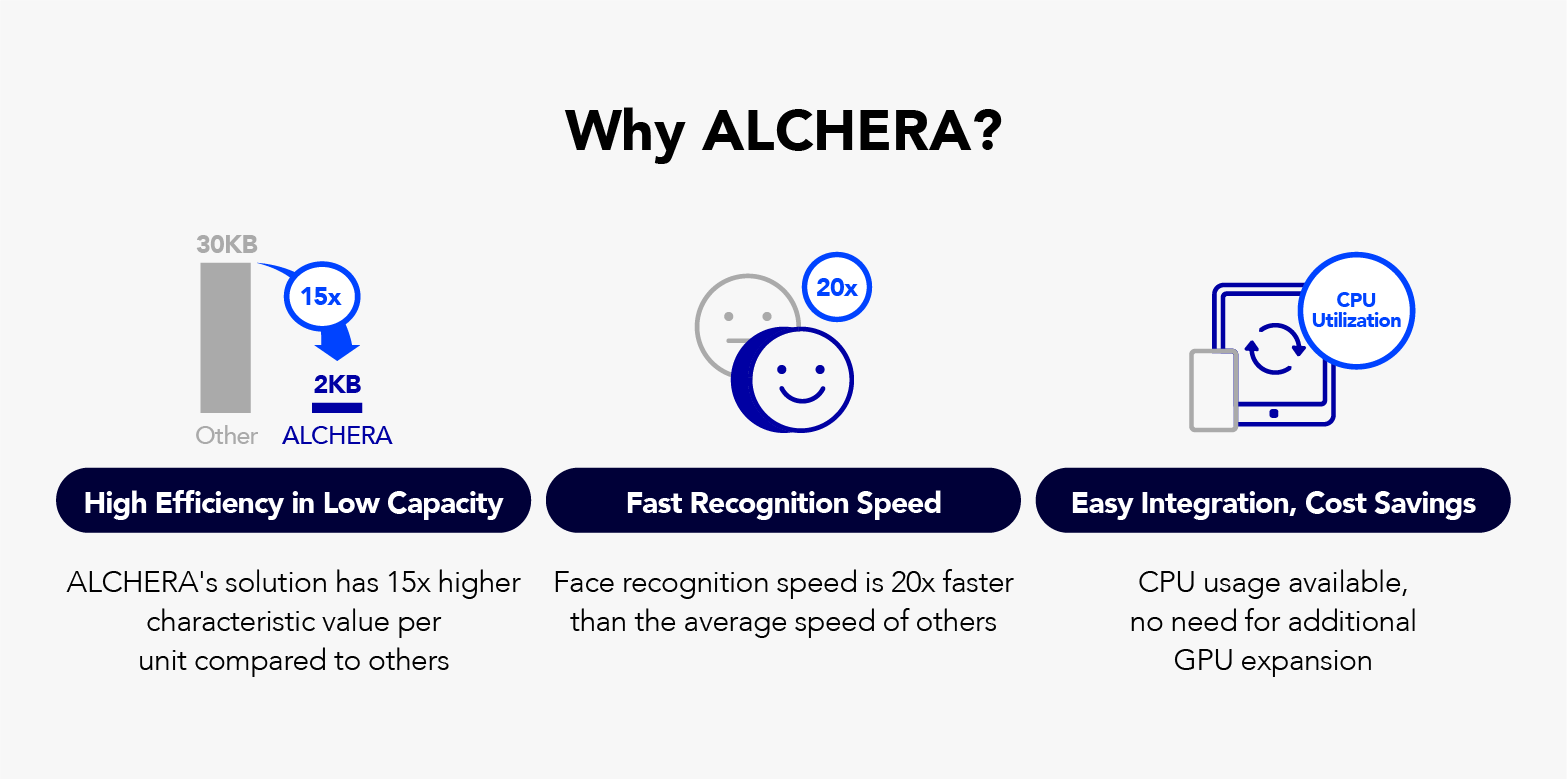

1) Low capacity and high efficiency

Alchera's face analysis solution is highly efficient with low capacity. Its face recognition AI analyzes real-time camera images to identify feature points and match them with registered face information. The feature value for one person's face is only 2 KB, 15 times smaller than the average 30 KB of other companies.

2) Fast recognition speed

Alchera's technology ranked first in the largest global face recognition test, FRVT, conducted by the U.S. Institute of International Standards (NIST), demonstrating its high recognition rate and speed. Authentication using the device takes only 0.2 to 3 seconds, which is about 20 times faster than other companies, allowing for seamless facial recognition in everyday life without the need for specific actions or selfies.

3) Easy integration and cost savings

Alchera's face analysis solution is cost-effective and compatible with CPUs without requiring a high-performance processor GPU. It provides advanced security and face analysis without the need for new servers or authentication devices.

New Finance That Alchera Will Change

Alchera provides solutions for secure self-authentication in multiple industries, including banking. It offers segmented security for key areas such as user and network security and introduces ownership and biometric solutions to enhance customer convenience.

Alchera's face recognition AI technology is designed for internal control and to prevent voice phishing, for both face-to-face and non-face-to-face financial services. As the No. 1 technology in Korea and globally, there is great anticipation of its utilization in pivotal industries, especially finance. Alchera's face recognition AI technology will shape the future of security and authentication.

This content is protected by copyright law and is owned by Alchera. Any unauthorized distribution or secondary processing is strictly prohibited without prior consent.

...

...