AIIR ID

AI Identity Verification Solution

Ensure seamless onboarding

with top-class security

Protect Your Business, Save Resources,

and Improve Customer Satisfaction

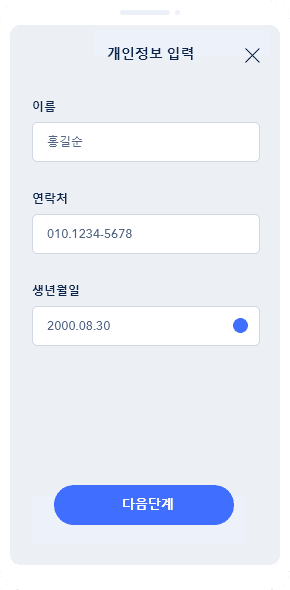

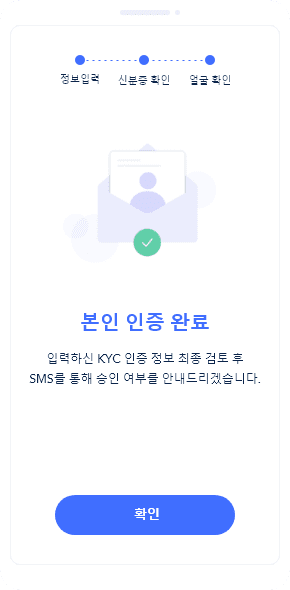

How it WorksSeamless Onboarding and Top-class Security

Seamless Onboarding and Top-class Security

with the AI ID Verification Solution

AIIR ID is an AI identity verification solution optimized for eKYC practices in the financial industry.

With ALCHERA’s state-of-the-art anti-spoofing technology, AIIR ID guarantees top-class security

by checking whether an ID card is authentic and whether the owner of the card is physically present

at the time of capture. You can onboard your end-users seamlessly and protect your business

from the ever-evolving fraud attacks.

WHY AIIR ID?The Next Generation

The Next Generation

Know-Your-Customer Solution

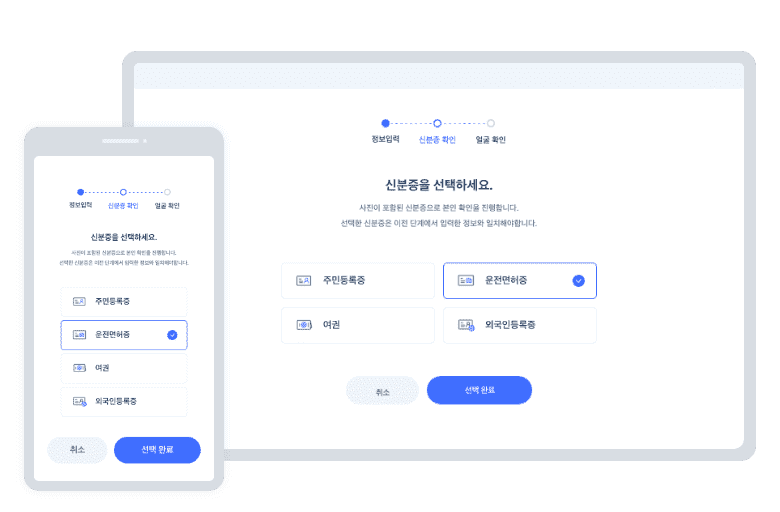

KEY FEATURES

- Extraction of text information and automated masking of sensitive private information.

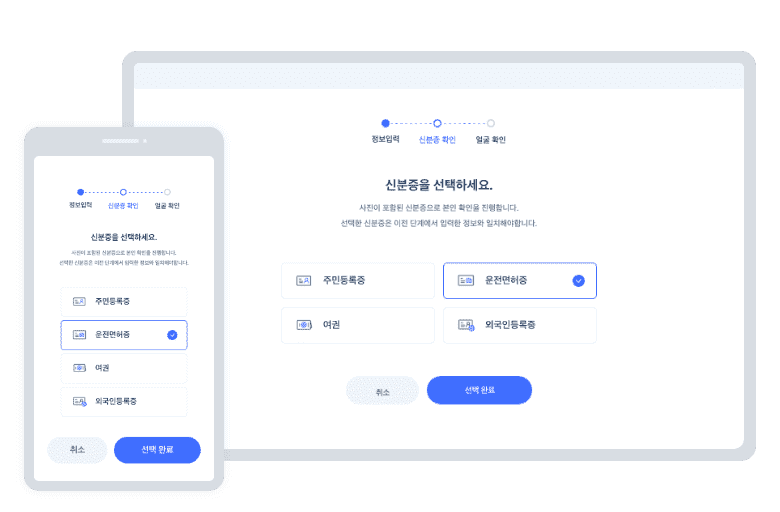

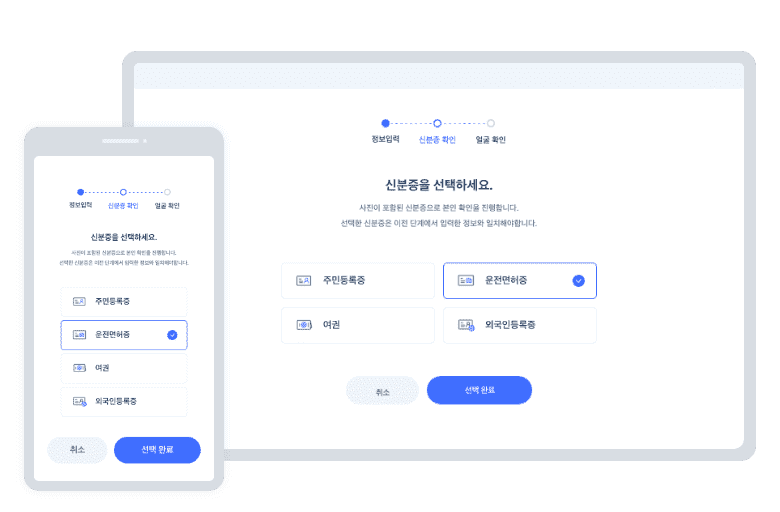

- Web pages that render well at all devices and platforms.

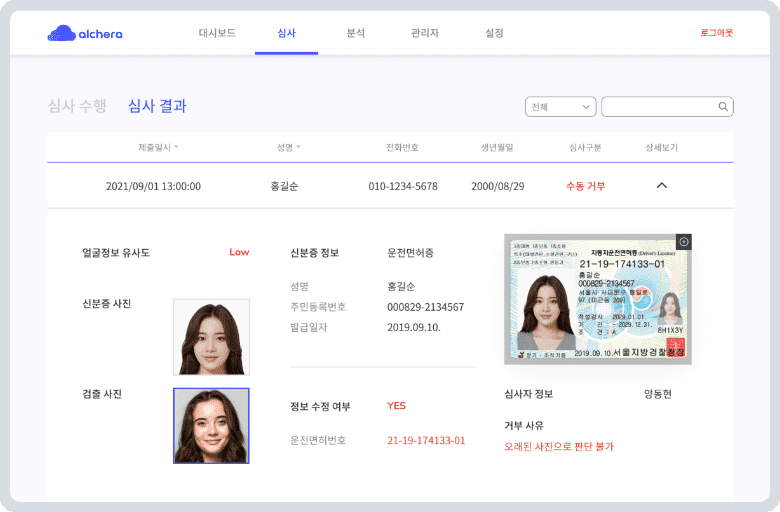

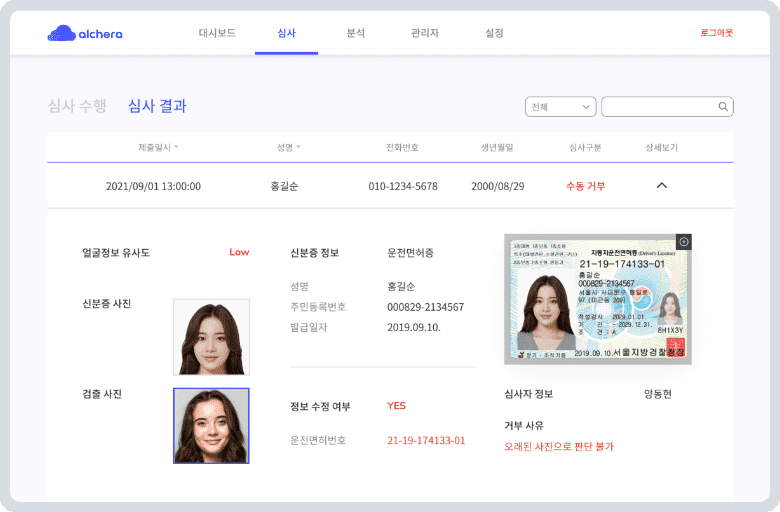

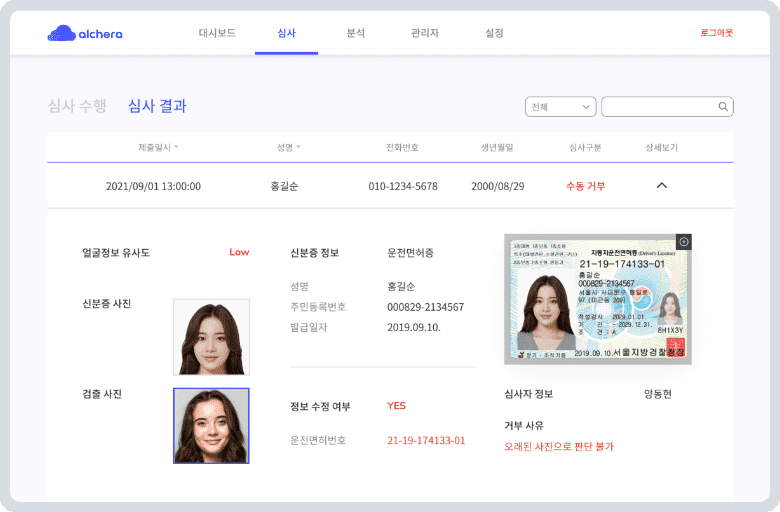

- Automated acceptance or rejection based on the similarity index of a photograph and ID card image.

- Manual approval by cross-examining a photograph and ID card picture.

- Review of cases that are either automatically or manually approved/rejected.

APPLICATION

Applicable Scenarios

USE CASES

AIIR ID is Trusted By

FAQ

[Features] What is the scope in terms of development support?

All our major services are provided in the form of API, SDK, and SaaS, with API and sample codes being directly

integratable with your frontend service. For the ease of development, we also provide documents specifying integration

standards.

...

...