Verification Solution of the Financial Sector with Face Recognition AI

ALCHERA

April 4, 2023

April 4, 2023

The Financial Supervisory Service's proposal for "innovation measures for internal control of domestic banks" and the Financial Services Commission's plan to "eradicate voice phishing" have become hot topics in the financial industry. These developments highlight the importance of a reliable and secure means of identification inside and outside the financial sector. The key issue at hand is the need for an "accurate means of identification that cannot be falsified."

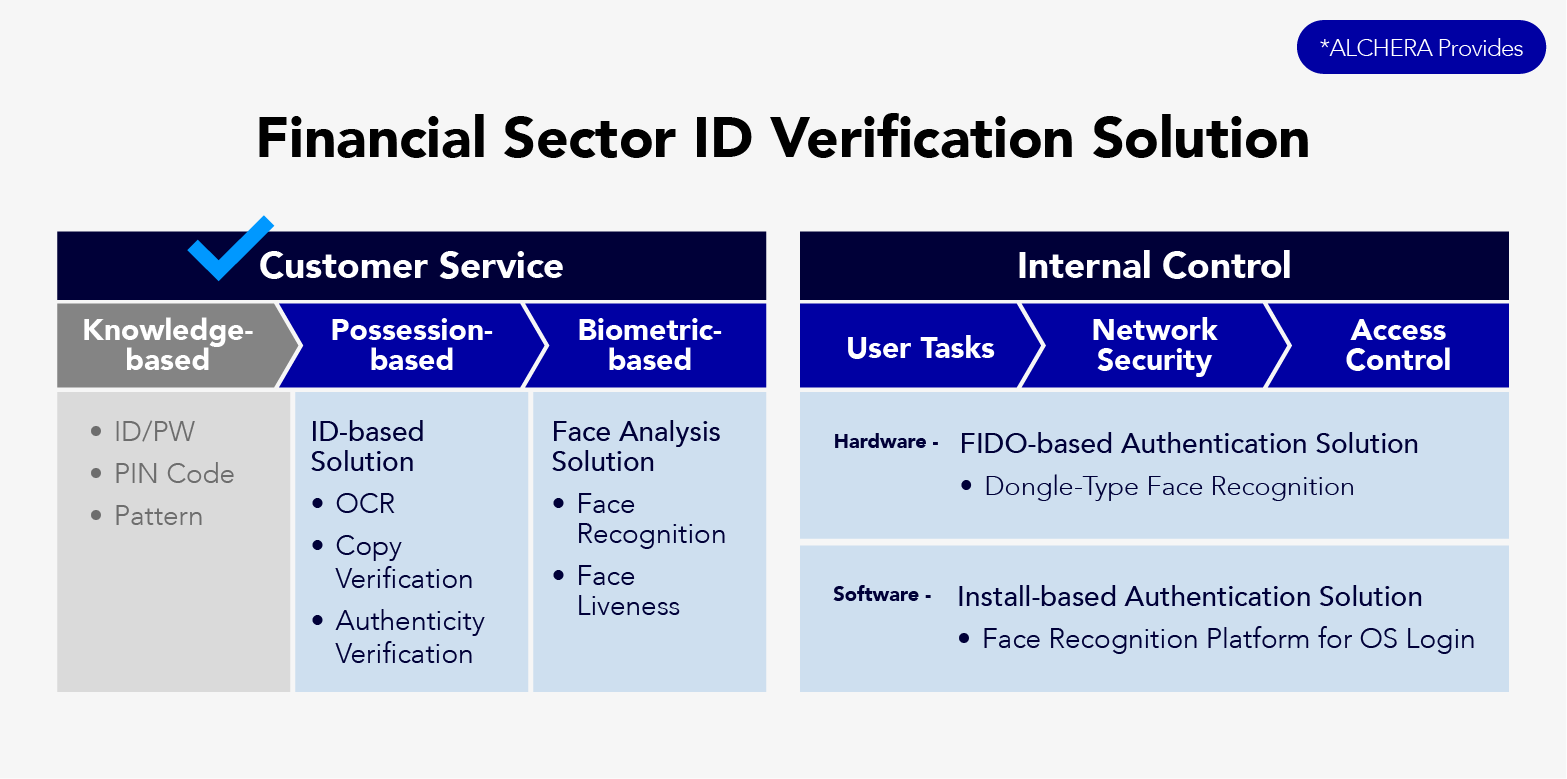

Alchera offers a biometric-based face analysis solution that uses ownership-based and human-specific biometric information. The solution has evolved from the traditional knowledge-based authentication method and ensures the stability of non-face-to-face financial services. This advanced security measure addresses both internal and external security concerns, providing a reliable authentication method for financial transactions.

Today, we will discuss face recognition AI technology for secure financial transactions.

Customer Service Area in Financial Sector: ID based Self-Authentication

Alchera offers an ownership-based authentication solution using identification cards and two main technologies.

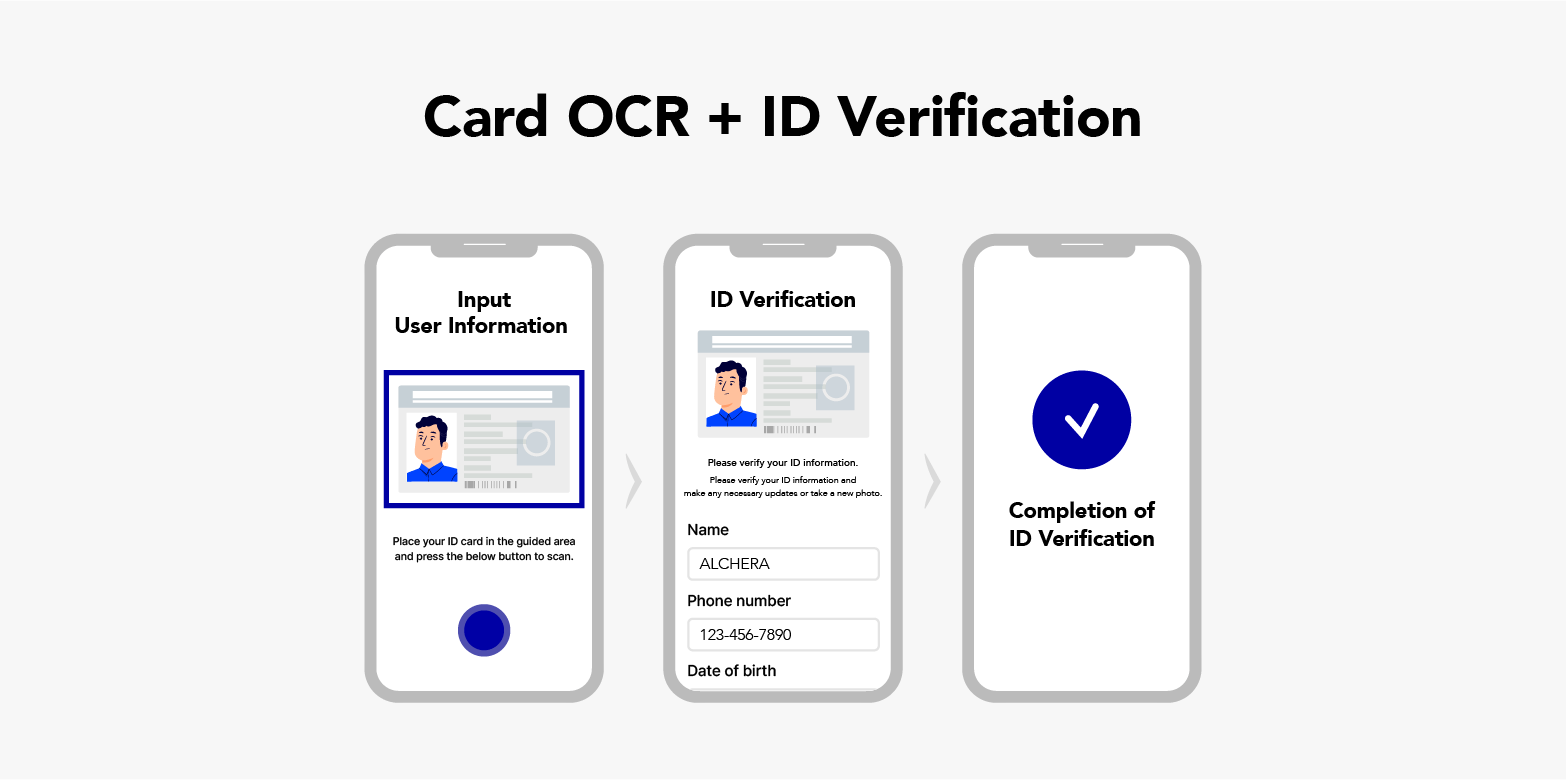

1,2) ID card OCR (Copy Verification) and ID Card Authentication

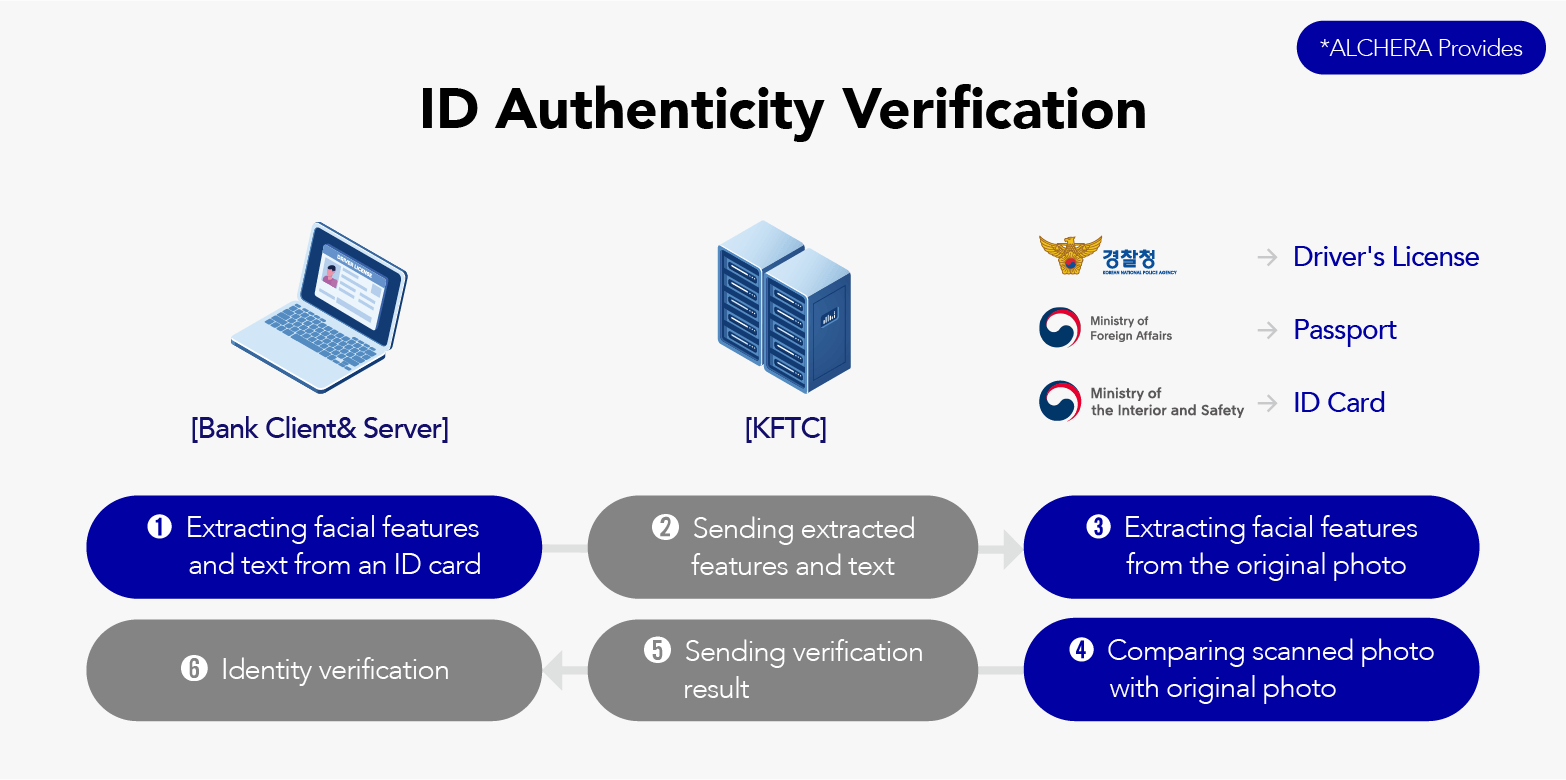

Alchera offers an ownership-based authentication solution using identification cards and two main technologies. OCR extracts text from identification cards, and verification ensures the authenticity of the extracted personal information. The key is to determine whether the card is genuine, not a copy or forgery. This technology enables more secure identification by confirming the card's authenticity through information collation.

Personal information extracted from a real ID card is verified against records from government agencies through the Korea Financial Telecommunications and Clearings Institue (KFTC). ID cards also contain image information, which can be matched with the user's face for added security.

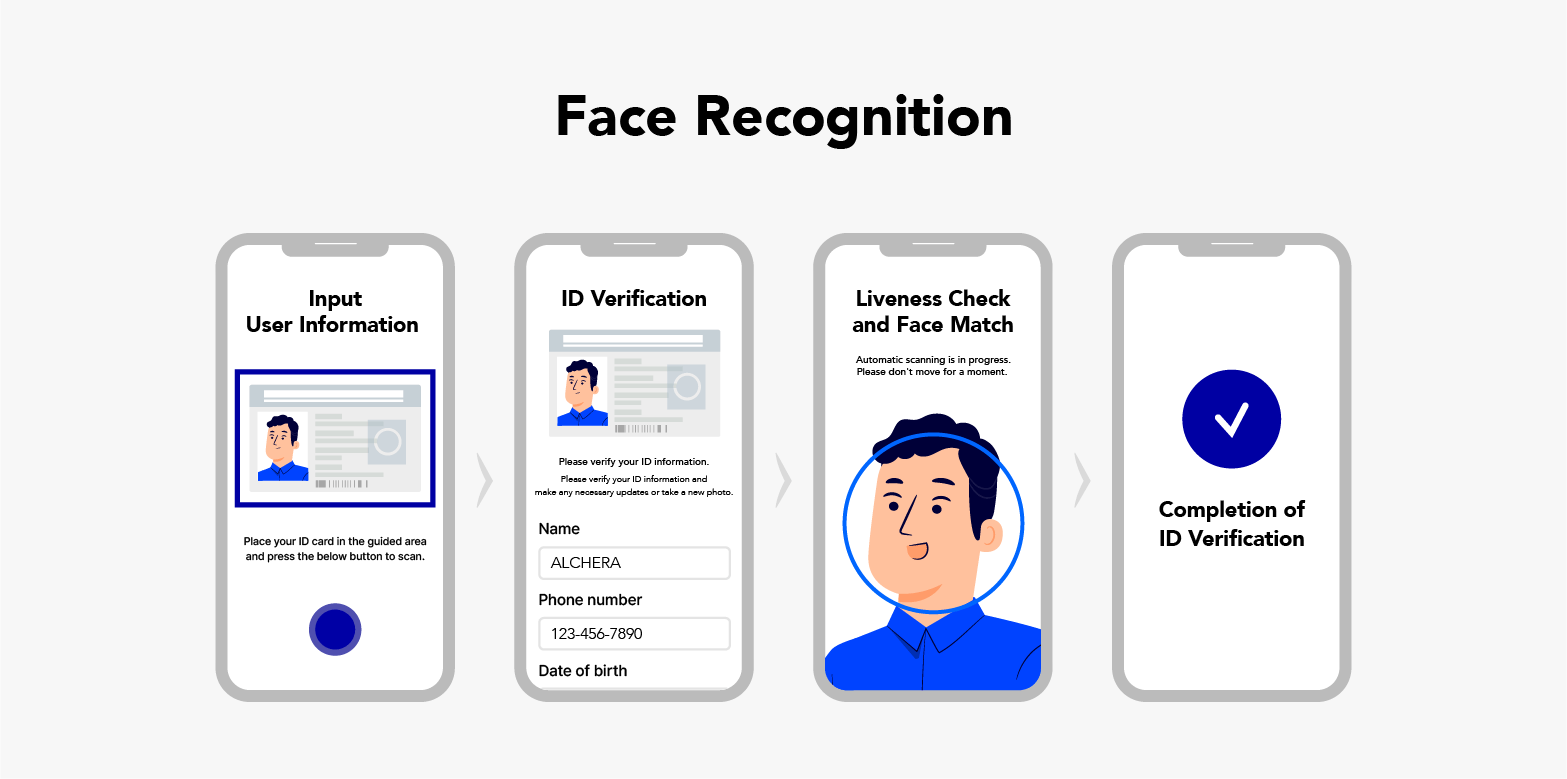

3) Face authentication

Face authentication datasets unique facial feature points for simple and secure identity verification through a selfie. It scans and analyzes the face image, comparing it to the ID card image to accurately verify the individual's identity. This provides advanced security by focusing on individual authentication rather than just financial transaction verification.

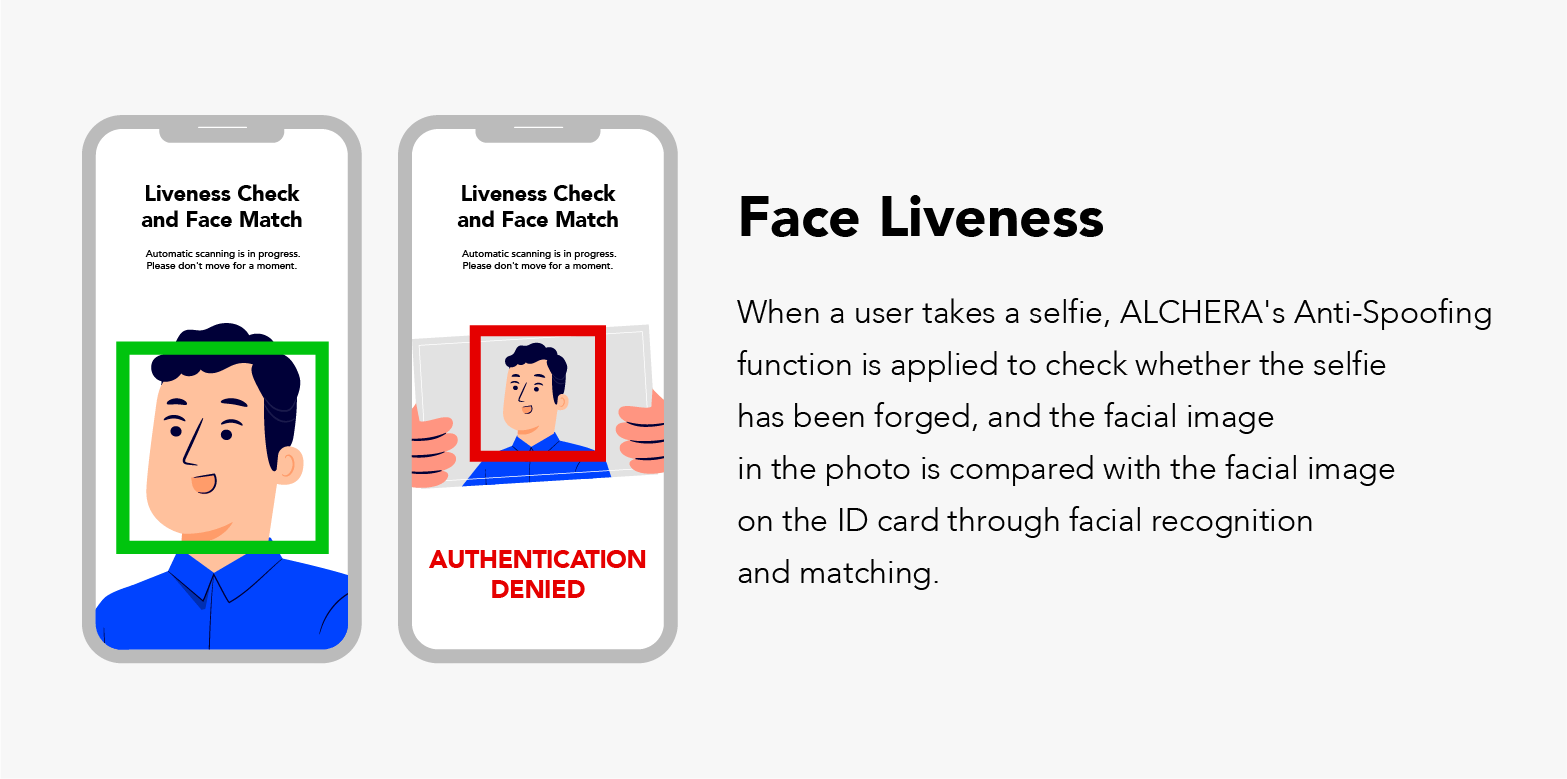

4) Face Liveness

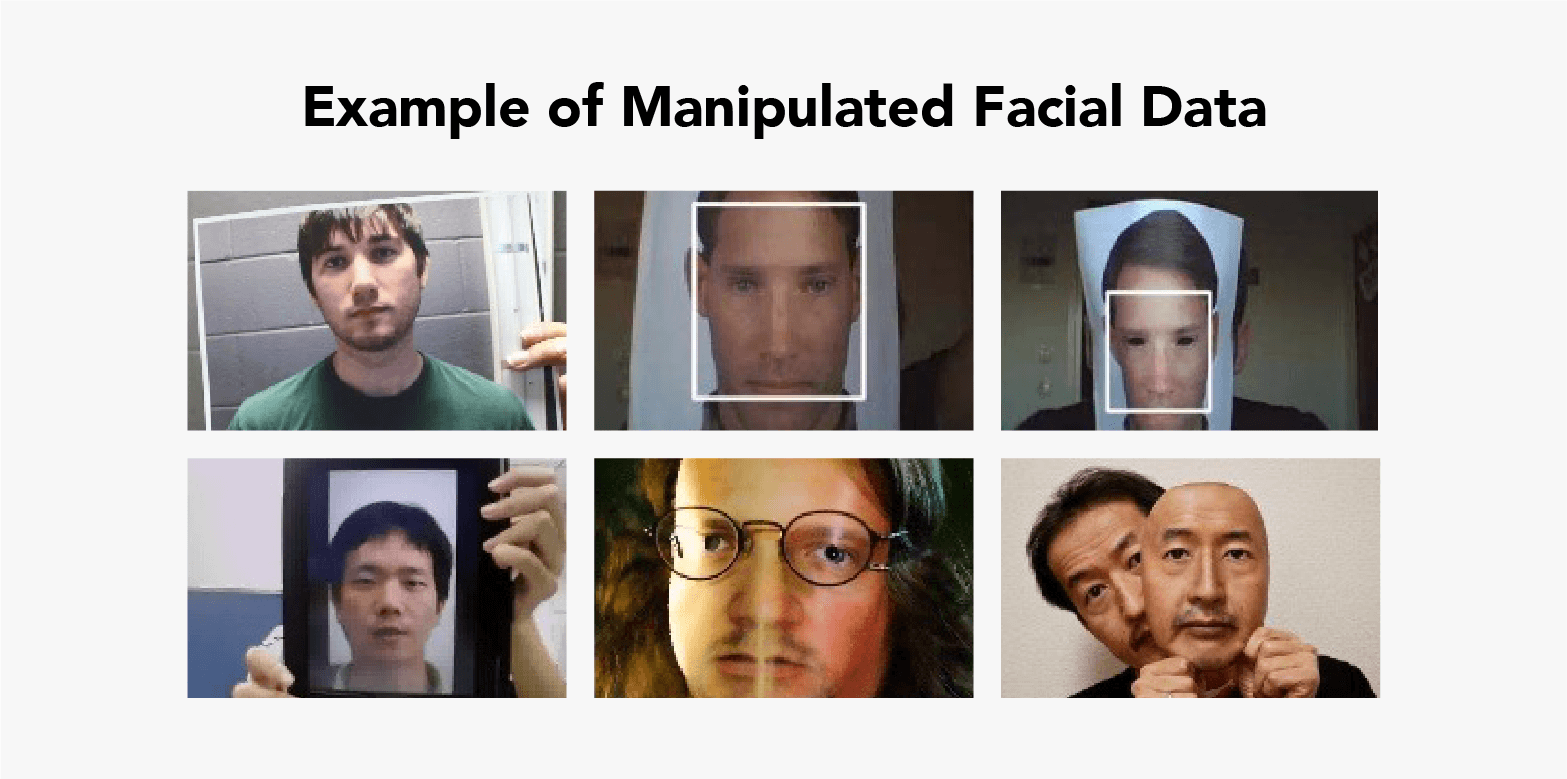

ID-based authentication provides relatively high security for non-face-to-face transactions, but vulnerabilities such as ID theft and fraudulent use of facial data exist. Alchera offers advanced face authentication solutions with face Liveness based on face recognition AI to overcome these vulnerabilities.

Alchera's Anti-Spoofing technology can detect forged images and videos of other people's faces, including 3D masks. Our functions are continuously updated to respond to fraudulent transaction attempts. We recently demonstrated better forgery detection performance than other companies.

Alchera's Face Recognition AI Technology, Where Is It Applied?

Alchera provides non-face-to-face self-certification solutions to domestic financial and fintech companies, including Toss Bank. Alchera's face recognition AI technology is used for login, identity authentication, and account opening through self-camera, streamlining the authentication process and improving speed and accuracy. One simple face authentication improves the customer experience.

Alchera's face recognition AI technology is used by Hyundai Marine & Fire Insurance Group to integrate various authentication methods into face authentication for all services. It's the first integrated certification service of insurance companies and sets them apart from competitors.

Technology to Lead New Financial Transformation

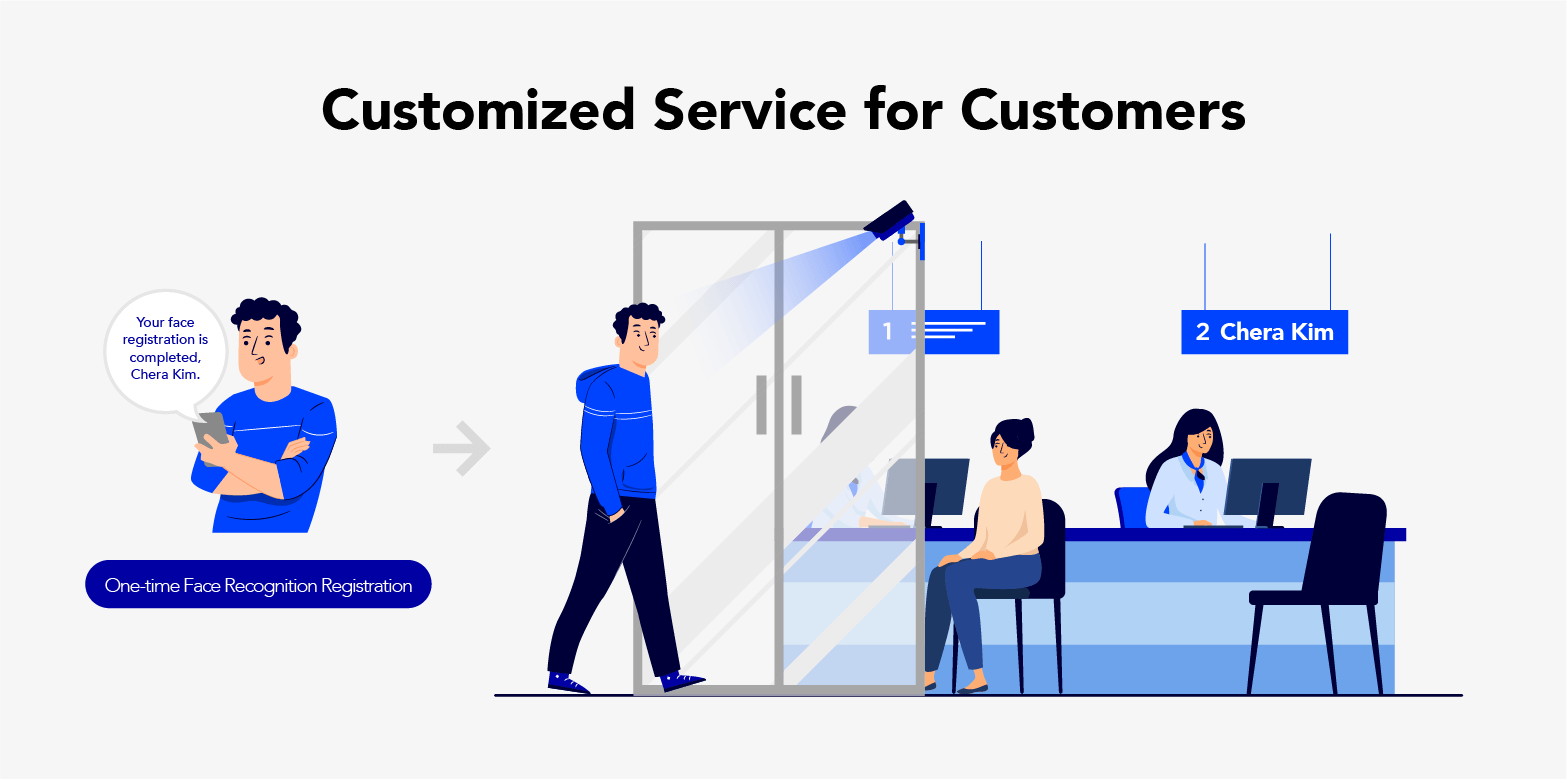

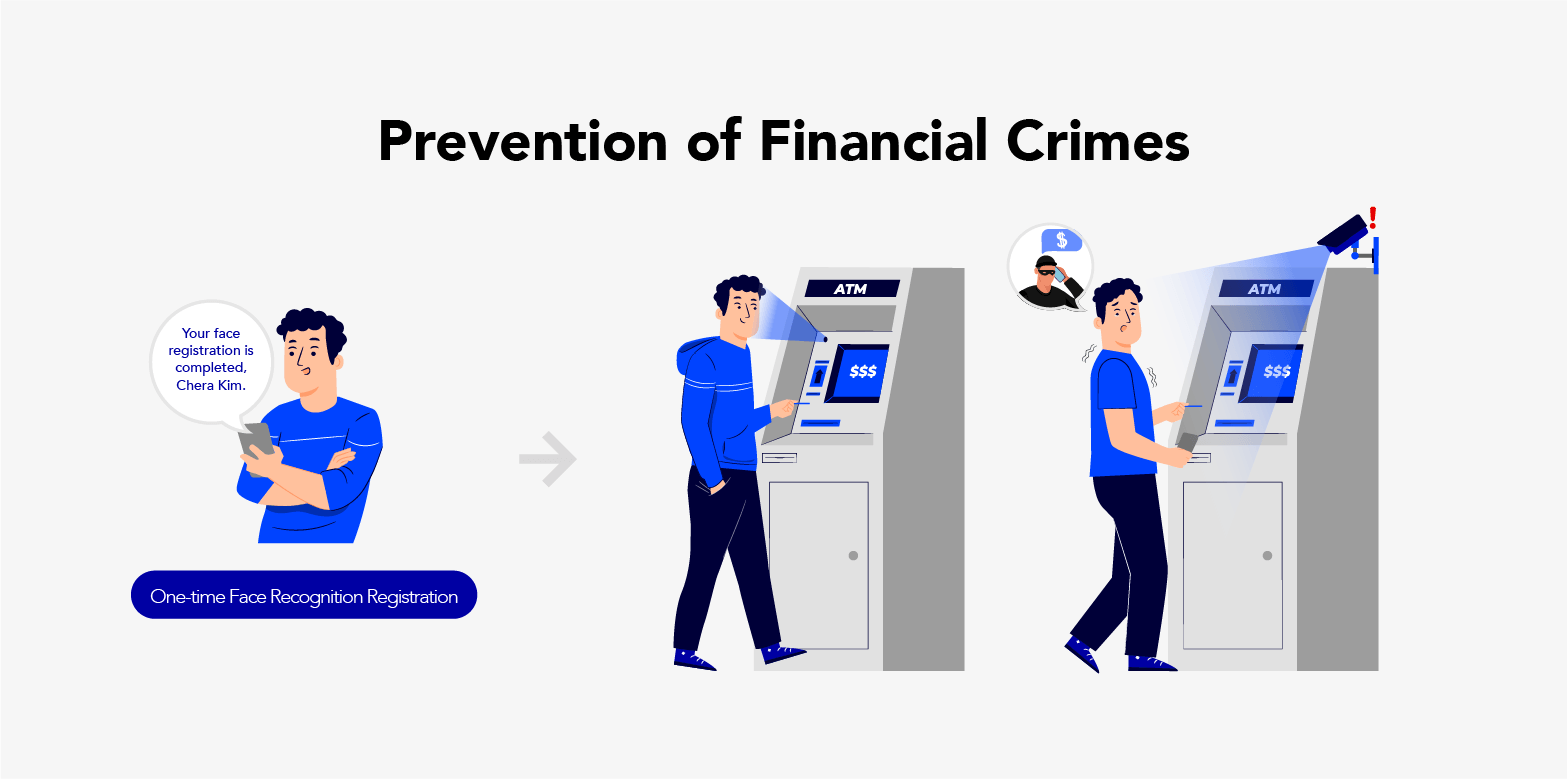

Face recognition AI technology can bring innovation to both non-face-to-face and face-to-face financial services, mainly in customized services and financial crime prevention.

Face recognition technology can personalize and improve face-to-face financial services. For example, banks can use ATM cameras or CCTV to recognize registered customers and offer personalized services and products.

It detects customer anomalies in front of ATMs, determining if two users are recognized or threatened. It can also establishes a system that can detect and respond quickly to pre-crime risks, including those that exhibit repetitive abnormal behavior. This can contribute to voice phishing and the eradication of various financial crimes.

Face recognition AI-based authentication has great potential in the financial industry. In the next episode, we will explore its background, technology, and advantages compared to other biometric authentication methods for internal control.

...

...