ID Verification for Safe Financial Transactions

ALCHERA

May 2, 2023

May 2, 2023

Table of Contents

Beginning of Non-Face-to-Face Financial Transactions

What are the Vulnerabilities of Non-Face-to-Face Financial Transactions

• ID Card OCR

• ID Copy Detection

• Identity Verification Solution

Can we really be safe from financial accidents?

Beginning of Non-Face-to-Face Financial Transactions

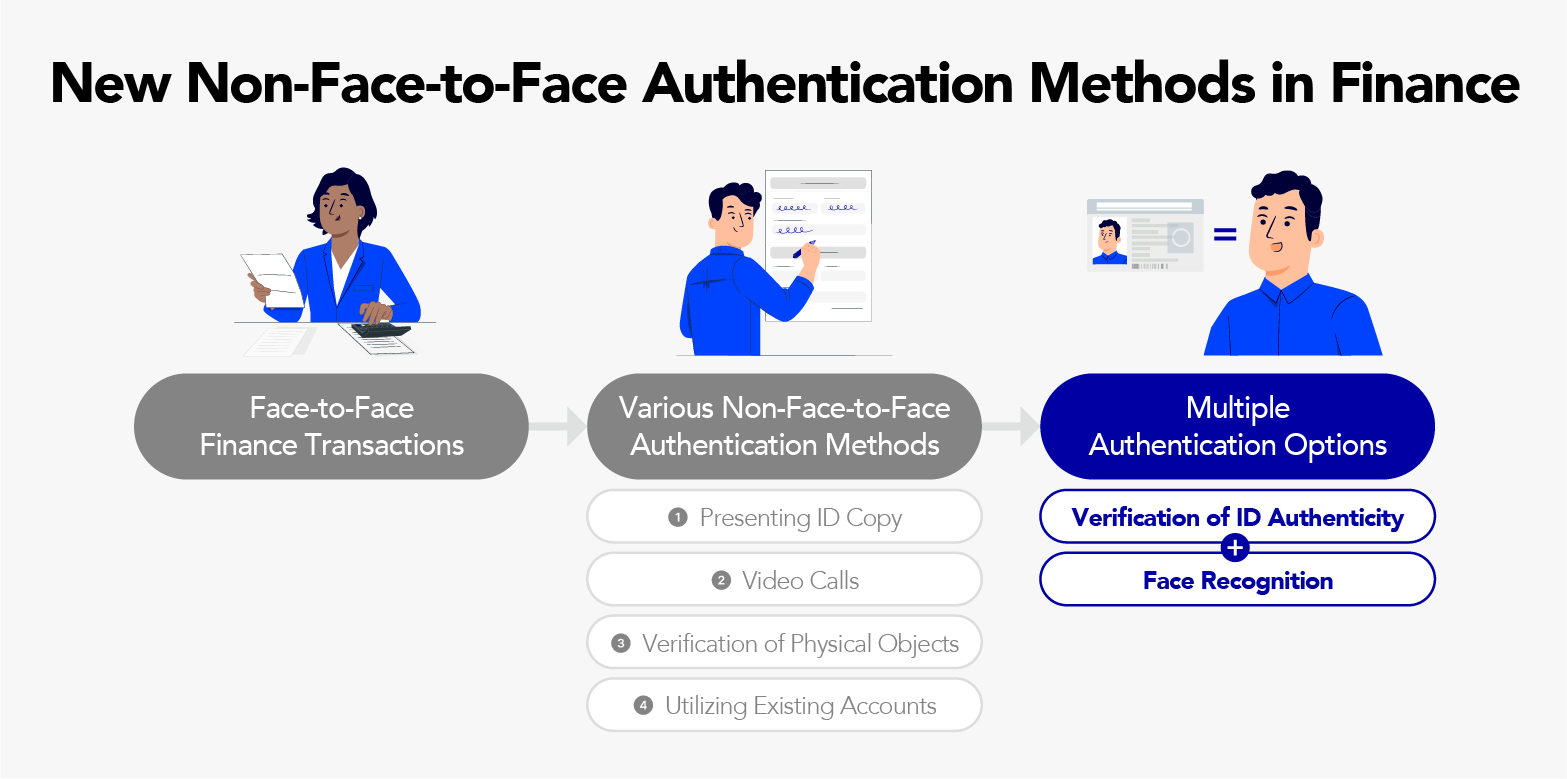

Recently, it has become possible to verify identity without physically visiting a bank through the non-face-to-face ID verification service. In 2015, the Korea Financial Services Commission introduced multiple verification methods to verify identities, preferring non-face-to-face over face-to-face methods.

Since 2016, the ID verification service has enabled consumers to verify their identities easily and accurately. This service allows financial companies to verify the authenticity of a customer's identity document in real time by comparing it with information registered with the issuing agency. With the emergence of Internet-only banks such as Toss Bank, the service has been widely applied in mobile financial transactions, making them a part of everyone's daily routine.

ALCHERA is working to establish a secure financial transaction environment by providing not only ownership-based identity verification, but also a biometric-based face recognition solution. In this article, we will discuss the vulnerabilities of non-face-to-face financial transactions and explore ALCHERA's solutions to address them.

What are the Vulnerabilities of Non-Face-to-Face Financial Transactions?

Financial transactions such as opening accounts and obtaining loans have become very convenient for users, who can take pictures of their IDs through apps and go through a simple authentication process. However, the risk of financial crimes has significantly increased due to vulnerabilities such as using only a copy of an ID for verification.

It is estimated that there were between 35,000 and 50,000 cases of financial crimes committed using a copy of a 2021 ID, and there were over 570 victims who suffered losses last year but did not receive any compensation.

The methods of financial crimes are becoming more diverse, such as using someone else's ID to activate a mobile phone, obtaining a mobile certificate or OTP, and withdrawing savings or loans in the victim's name from their existing accounts.

To prevent such incidents, banks and financial institutions are introducing ID verification solutions in their non-face-to-face authentication systems.

We will explain what identification forgery detection technology is and how ALCHERA's verification process works.

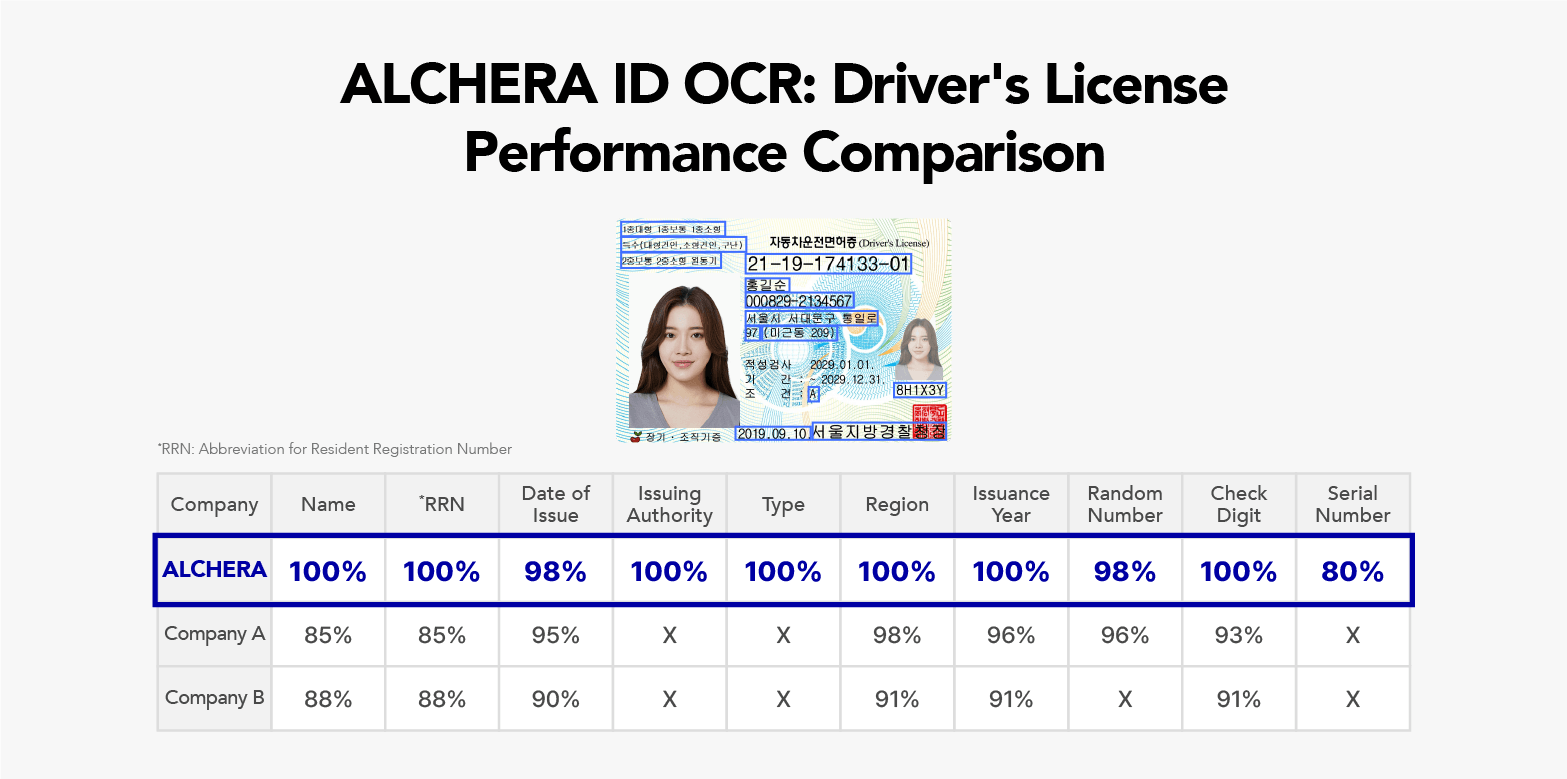

1. ID Card OCR

A solution that extracts personal information as text by taking a picture of an ID card. Through an OCR (Optical Character Recognition) engine, printed characters are digitized and then compared with the government ID database to verify its authenticity.

ALCHERA's ID OCR authentication boasts a recognition rate of over 97% within one second. *Based on patented image preprocessing technology, image refinement adjusts for shaking, focus, brightness, and resolution, and filters out low-quality images, improving the detection rate of the entire system with high-quality images.

*ALCHERA holds patents in Korea and US - KR 10-2226843: Object Detection System and Method / US 11,281,930: System and Method for Object Detection.

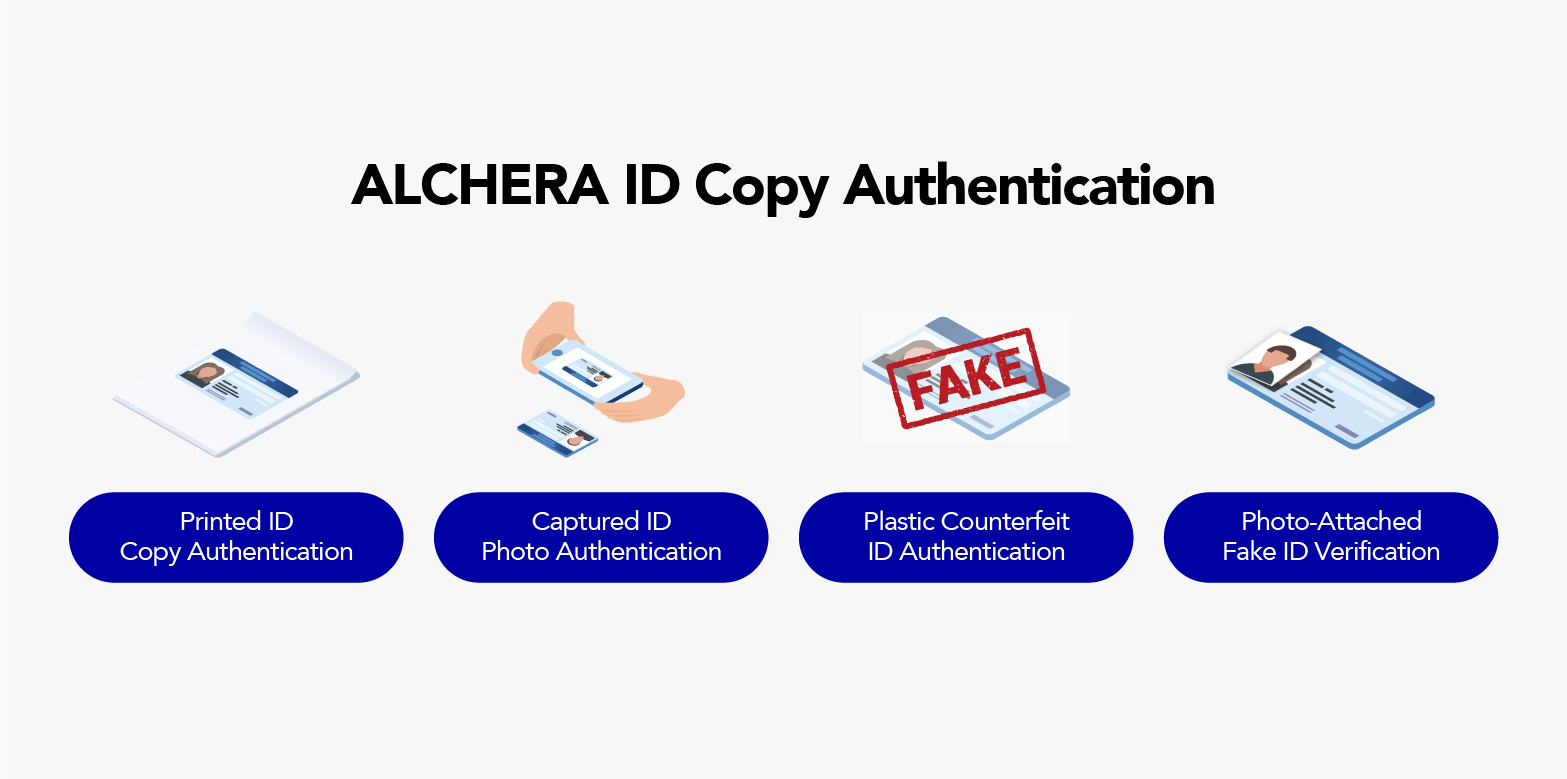

2. ID Copy Detection

ALCHERA distinguishes various fraudulent IDs, including printed ones, ID photos on smartphones or monitor screens, plastic forged IDs, and photo-forged IDs. ALCHERA's accuracy in discriminating ID card copies boasts over 99%, preventing accidents caused by ID card leakage and theft with high performance.

Through its own data center, ALCHERA secures more than a million pieces of data and conducts high-speed and high-precision document authentication with continuous learning. ALCHERA is capable of handling at least five types of forged identification cards in around 200 situations, such as in low lighting and at various shooting angles. Through its advanced capabilities, ALCHERA supports quick and accurate determination of whether a document is genuine or a copy, using a lightweight deep-learning model on low-spec hardware.

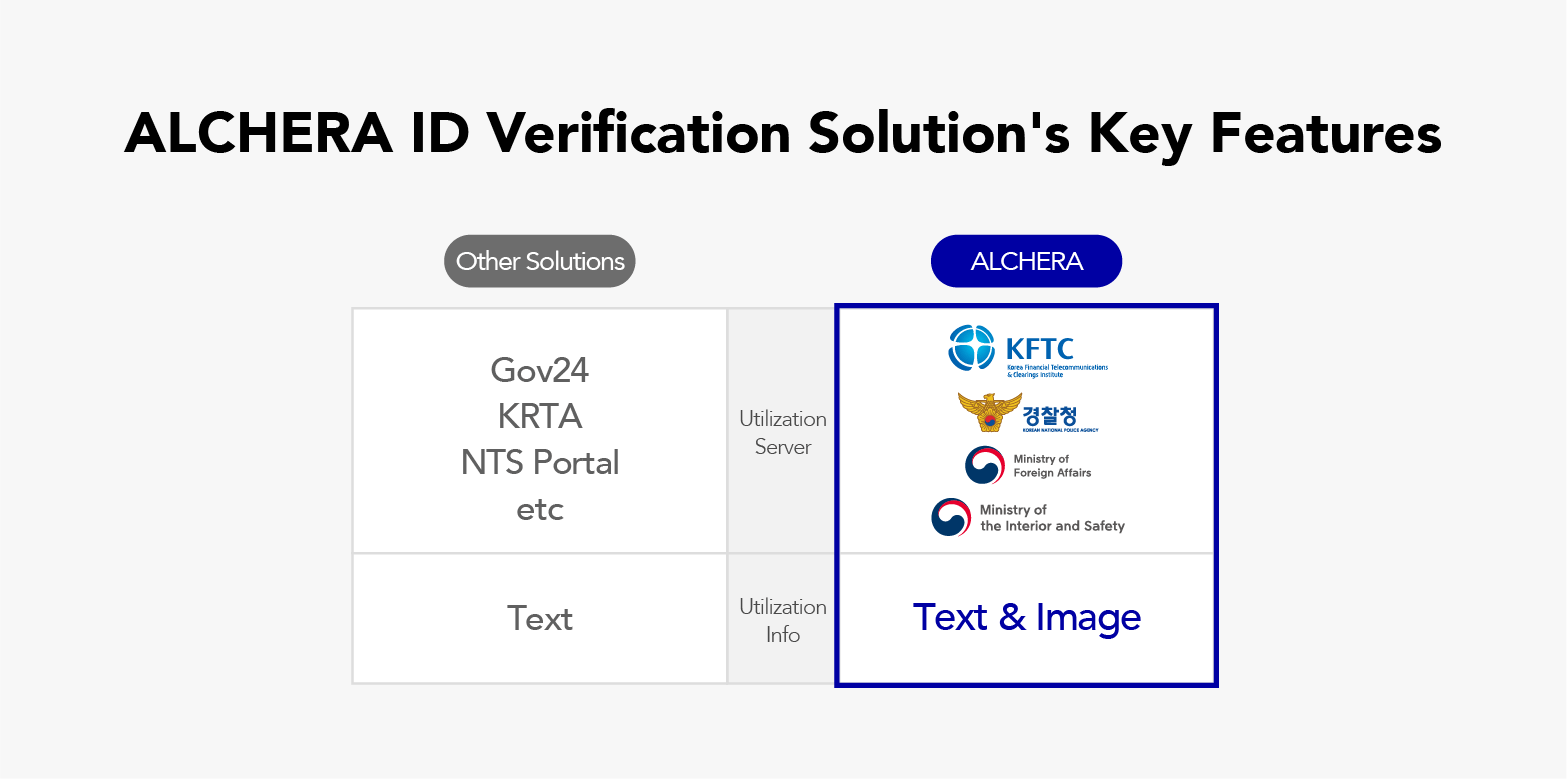

3. Identity Verification Solution

ALCHERA confirms the identity of an individual by comparing and verifying the photo and text on an ID with the information registered in government agencies including Korea Financial Telecommunications & Clearings Institute (KFTC). ALCHERA provides three types of ID verification services, including resident registration cards, driver's licenses, and passports, through the KFTC and Public Information Sharing System.

ALCHERA is the only company in South Korea that compares personal and image information registered in the Ministry of Administration and Safety, the National Police Agency, and the Ministry of Foreign Affairs simultaneously, ensuring high reliability and stability in confirming the identity of an individual. This is ALCHERA's unique selling point.

Currently, the Identity verification solution utilizes a scraping technology. This technology verifies authenticity by comparing text information such as name, resident registration number, and issuance date, along with information provided by portals such as government services, the Road Traffic Authority, and the National Tax Service.

*Technology that retrieves data and information from web pages.

ALCHERA verifies authenticity by comparing and verifying the text and image information stored in the databases of the Ministry of Administration and Safety, the National Police Agency, and the Ministry of Foreign Affairs. This not only guarantees higher reliability and safety, but also enables more accurate identity verification.

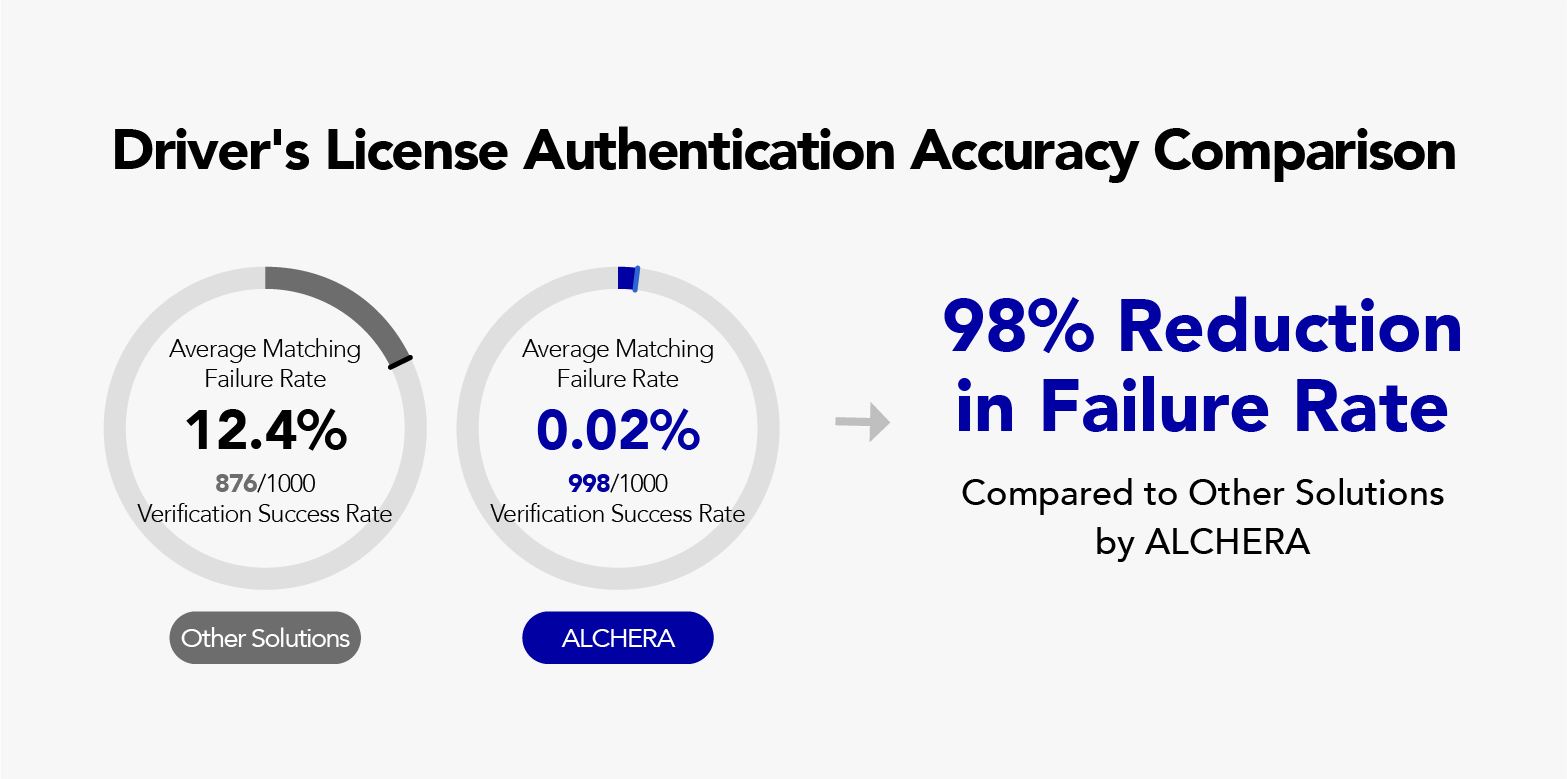

In 2021, ALCHERA demonstrated its technical capabilities with outstanding results in the face image matching performance test conducted by the National Police Agency using physical driver's license images and registered face images in their database. Matching about 25,000 pieces of data, the failure rate per 1,000 cases was reduced by 98% compared to the existing solution used by the police agency, with a failure rate of only 0.02%. Based on these results, ALCHERA's solution has been utilized by the National Police Agency since 2022.

Can we really be safe from financial accidents?

Through ID OCR, copy detection, and verification, we can establish a high level of security and a secure non-face-to-face financial transaction environment. However, in the case of ID-based authentication, there are also limitations in that it is vulnerable to ID theft, although it is possible to respond to forgery. Concerns continue to be raised that we should be able to defend against attempts to engage in fraudulent transactions by acquiring someone else's physical ID.

In December of last year, the Director of the Financial Supervisory Service announced in a policy discussion on "Promoting Non-Face-to-Face Biometric Authentication for Preventing Financial Crimes" that financial crimes exploiting vulnerabilities in non-face-to-face channels are evolving rapidly, and in order to overcome this, the financial industry will build and expand a non-face-to-face biometric authentication ecosystem.

Among biometric authentication methods, facial recognition in particular is receiving significant attention for its advantages in both accuracy and convenience of implementation, thanks to advancements in AI and deep-learning technology.

In the next section, we will introduce ALCHERA's leading facial recognition solution.

ALCHERA will continue to make efforts to prevent financial fraud and voice phishing and create a safe environment for financial transactions.

...

...